Before buying a house, extremely Canadians know that they are going to have to make an excellent downpayment with a minimum of 5% or more. But you will find several other initial costs you will possibly not keeps idea of it fall into the class regarding closing costs, and additionally they will likely be significant.

Exactly how much can i budget for household settlement costs?

In most cases away from thumb, you really need to finances at least step one.5% of the house price to have settlement costs. Instance, if you are purchasing a property to own $300,000, you’ll have at the very least $4500 available for settlement costs. You will need to has 1.5% readily available for closing costs to qualify for good CMHC-covered financial.

Exactly what if you find yourself buying and selling property during the same time? Due to the fact a few purchases are happening, your closing costs will be high. In this like, I will suggest that you have at least 4-5% available, which have entry to subsequent crisis reserves if required.

Today, you are curious why you would need as much as $fifteen,000 to have closing costs for the a $3 hundred,000 domestic purchase, particularly if your lawyer has actually told you you to definitely its fee are only $1000. Courtroom charges just make up a portion of the total closing costs. To ideal comprehend the complete costs, let me reveal a dysfunction:

Post on mortgage closing costs

Out-of judge costs to home import tax, we have found a list of closing costs we provide when buying a house.

Courtroom costs

After you get otherwise sell a house, a genuine home attorney have to handle the order, and of course, you will find costs with it. Since the cost of hiring a lawyer may vary, lawyer costs can range between $five-hundred and you can $1000. Home solicitors carry out several extremely important commitments. It pull people required title lookups and you can advise any potential problems, ensure that your court documents is completed and you can recorded precisely, and work at their bank to help you support the latest economic transaction.

House import income tax

Based your geographical area, youre at the mercy of anything entitled an area transfer income tax when you purchase a selling domestic (the brand new create belongings are typically exempt). The quantity the weblink is roofed on homebuyer’s settlement costs within time of arms.

The level of house transfer tax which you shell out is actually an effective percentage of this new residence’s purchase price. Tax costs vary ranging from provinces, you need look at the payment your local area to shop for.

- Around $31,000 0%

- $30,001 to $ninety,000 0.5%

- $90,001 to $150,000 1.0%

- $150,000 to $200,000 step 1.5%

- Number more than $two hundred,000 dos.0%

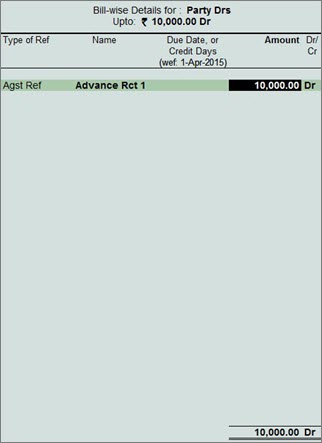

Let’s say you purchased an effective $325,000 household within the Winnipeg, Manitoba. Brand new province tend to calculate their belongings transfer tax number as follows:

- $30,000 $0

- $60,000 X .5% $3 hundred

- $60,000 X step 1.0% $600

- $fifty,000 X 1.5% $750

- $125,000 X dos.0% $2500

Complete LTT payable $cuatro,150

Perhaps you have realized, the degree of home import income tax you pay is tall. If you reside into the Toronto, the situation are dreadful having homebuyers, who have to expend a couple house transfer fees: you to the latest province and something for the City of Toronto. When you cause of Toronto property rates, the expense was downright absurd.

As opposed to Manitoba and you can Ontario, Alberta does not have any an area transfer taxation, while they possess an area transfer management fee.

Survey percentage

Very mortgage brokers requires a secure questionnaire developed by the fresh new seller on the homebuyer if one is obtainable. A secure questionnaire maps away a good property’s borders knowing in which your home closes, plus neighbour’s initiate. If there’s zero questionnaire readily available, you’re compelled to buy a separate one since the this new homebuyer. The expense of a secure survey can vary of $500-$1500.