Fees getaways, also known as commission holidays otherwise mortgage deferment, was a component of a few low-rate lenders that enable consumers to briefly end and also make payments on their mortgage.

Through the a cost holiday, new debtor does not need to make money on loan getting a-flat time frame. With regards to the financial in addition to sorts of financing, fees getaways is readily available for a period of several months if you don’t as much as a year.

By firmly taking an installment escape, consumers can be free up some funds move and rehearse the money with other pressing means. It’s important to remember that fees vacations are just offered whenever your payments have get better, aren’t on focus just funds, and apps is at the mercy of the fresh new lender’s acceptance.

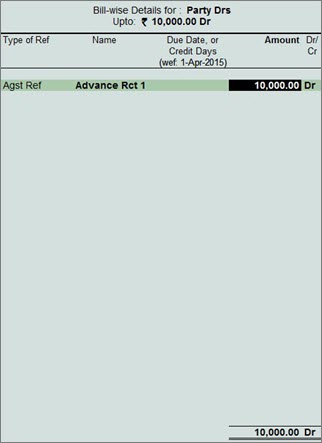

At the Qudos Financial, we explore a regular attract calculation approach to dictate the eye charges for your Cheap Mortgage. As a result the interest on your financing is actually calculated to the an every day basis, in line with the a fantastic equilibrium of your loan.

Our very own mortgage appeal computation method allows around 10 decimal places during the rounding the newest day-after-day interest. This level of precision means interest percentage is calculated since the truthfully as possible, and that you are just billed the proper amount of appeal on the the loan.

You will need to note that the pace on your Reduced Costs Mortgage can vary over time, according to field criteria or other products. We remind one to stand right up-to-big date in your interest in order to speak with one of the credit specialists when you yourself have any questions otherwise inquiries. Continuer la lecture de « This might be usually provided by lenders to have lenders, personal loans, or any other version of consumer fund »