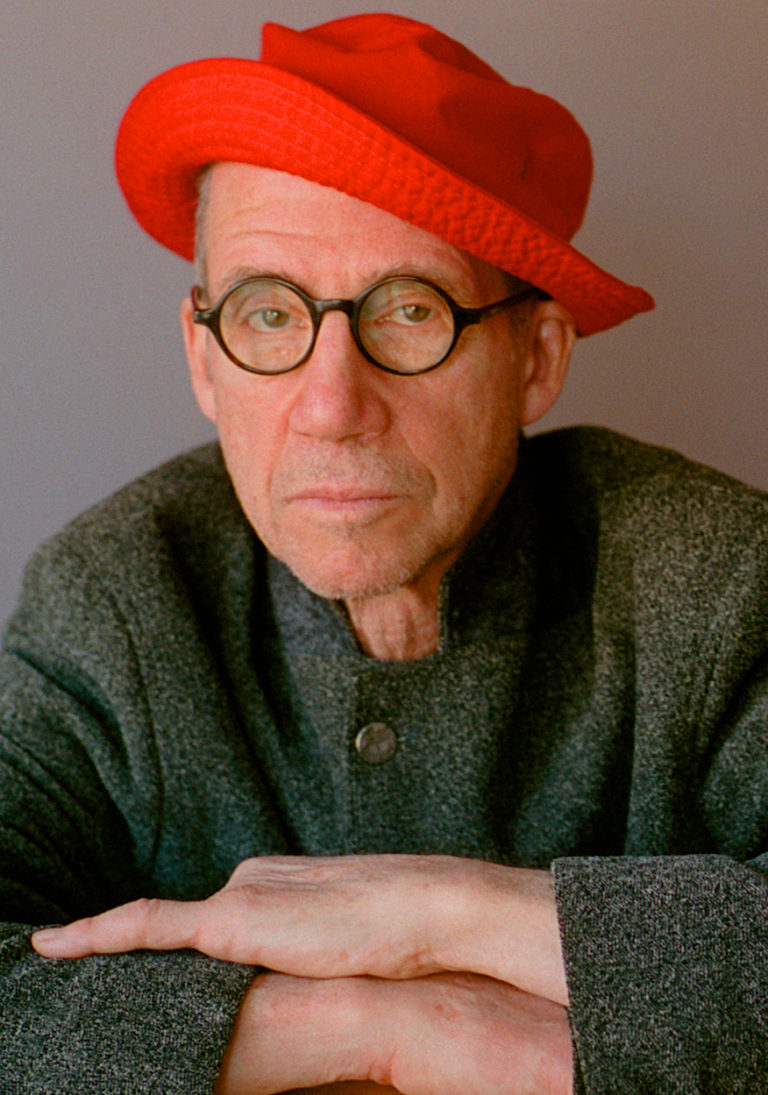

- John Dela Cruz, Dominating Lawyer

Knowledge Manager Builder Funds during the South Australian continent

Navigating this new monetary channels available to proprietor-developers during the Southern Australia needs a-deep dive into truth off owner-builder finance. When you look at the SA, financial institutions render customized alternatives customized especially for those individuals trying out the fresh builder’s role by themselves. Yet not, talking about perhaps not your own work with-of-the-mill lenders; they are available due to their unique gang of standards and you can criteria owed toward seen improved chance.

Manager creator funds try distinctive line of because they necessitate a top equity needs and a detailed endeavor plan. Lenders want to see your capability to manage your panels efficiently, that has having good, council-accepted preparations and you may an obvious report on the anticipated framework can cost you. Engaging early having creditors you to specialize when you look at the holder creator finance Southern Australia can give you a sharper path towards protecting their funding. These fund often function adjustable words based on the project’s scope along with your financial history, reflecting the significance of a properly-wishing loan application.

Navigating Owner Creator Loans when you look at the SA

Protecting that loan because an owner-builder inside Southern Australia is somewhat challenging. The brand new difficulty is based on the need for comprehensive paperwork and you may evidence of power to manage a substantial structure endeavor. Loan providers have become careful, requiring sets from council-approved intends to an intensive cost dysfunction. It rigour stems from the increased dangers of the proprietor-treated construction plans, where waits and you will funds overruns are not strange.

To alter your chances of financing recognition, its important to expose a highly-prepared economic plan. Seeing financial advisors just who specialise regarding framework market is also give you the information needed seriously to navigate holder builder financing SA effortlessly. This type of advantages will help from inside the polishing your own project’s financial blueprint, making sure your meet all of the lender’s requirements and you may mitigate possible threats effectively. More over, exhibiting an effective understanding of the development schedule and you can related can cost you is also reassure loan providers of one’s project’s viability plus financial management acumen.

Budgeting Strategies for Building inside the SA

Effective budgeting is actually a cornerstone out-of profitable construction systems, especially for manager-designers from inside the South Australia. Before starting your own generate, it’s important to cautiously bundle and guess all you can easily can cost you , out-of information and you will labour so you can it allows and you can contingencies. Utilising devices particularly construction cost management application can be build what you can do to track expenses and you can would money effectively.

To possess holder-builders, a highly-prepared finances ought to include a contingency finance with a minimum of 10-15% to cope with unforeseen will set you back, which are a familiar thickness within the design. This shield makes you deal with unexpected situations as opposed to jeopardising all round monetary fitness of your own opportunity. As well, integrating budgeting tricks for strengthening SA in the economic means ensures which you remain on most useful of one’s expenses and avoid brand new pitfalls out-of overspending or underestimating will cost you. Continuously reviewing your financial allowance since the investment moves on is additionally essential, allowing you to build adjustments in response to help you actual-day monetary demands.

Budgeting to have Holder Designers into the SA

Handling design costs effectively is an additional vital element of financial expertise having manager-designers when you look at the South Australian continent. It is really not unusual to own build strategies to tackle rates overruns; yet not, these can end up being lessened which have proactive budgeting measures. That energetic strategy is to try to build relationships a homes rates movie director that will offer professional suggestions for finances think and cost manage.

A homes prices movie director specialises into the navigating the causes of design expenditures, helping to ensure that your investment stays in this budget. The systems should be indispensable from inside the distinguishing prospective deals and you may to prevent high priced errors. That it top-notch help is specially beneficial in aligning towards the costs management for proprietor designers SA measures, and this work with optimising capital allowance and you will cutting spend. By implementing rigorous cost management means from the start, you might safeguard your project facing economic setbacks and keep maintaining handle more your own structure budget.

Accessing Proprietor Creator Has from inside the South Australian continent

Getting proprietor-builders inside Southern area Australia, there are certain has available that will provide big financing. The initial Homeowner Grant (FHOG) was a notable analogy, giving doing $fifteen,000 so you’re able to eligible someone carrying out the earliest domestic generate. Understanding and being able to access these types of manager creator has Southern Australia can rather lower your initial can cost you and offer a much-required boost for the finances.

Qualification for these features generally hinges on conference particular conditions, that could range from the character of the investment and personal financial circumstances. It is very important shop around and implement of these grants since very early you could to be certain your increase the fresh new financial support readily available. While doing so, local councils and you may county governing bodies usually have more tips and advisers who will help you in navigating the application processes effectively.

Of the leverage the newest financial professionals considering using these features, owner-developers is alleviate some of the financial challenges of its tactics, deciding to make the dream about strengthening their unique home a great deal more achievable and economically green.

Financial Planning for Framework inside SA

Complete monetary thought was crucial to have minimising risks and guaranteeing bad credit personal loans Massachusetts the fresh popularity of design methods getting holder-designers in the South Australia. This step begins with detail by detail rates anticipating and you will extends to normal funds studies and you can status from the opportunity lifecycle. Stepping into comprehensive economic planning for structure SA makes it possible to maintain a definite post on your financial position and you can adapt to people change that can happen during the construction phase.

That trick aspect of financial thought try making certain that you really have enough funding to cover all of the phases of build, off 1st construction so you’re able to final meets. Including securing even more money otherwise reallocating this new finances because the necessary to defense unforeseen will set you back. At exactly the same time, considering much time-title financial implications of build selection, such materials and you may strengthening procedure, normally notably impact the total price from possession and upcoming expenses, such as for instance maintenance and energy performance.

Daily seeing a monetary coordinator which knows the development industry can give you the strategies wanted to keep your endeavor economically viable. That it professional advice is crucial to avoid well-known dangers that could bring about economic filters or project failure.

Empowering Your own Framework Journey

Finding monetary mastery while the a proprietor-creator during the Southern Australian continent relates to significantly more than controlling a great finances or protecting financing. It needs a comprehensive understanding of this new financial landscaping, proactive management of framework will set you back, and you will and make advised conclusion you to make that have both the quick and you may long-label monetary needs.

As a beneficial solicitor and you may design attorney with over ten years off experience, I’ve had brand new privilege away from telling and you may symbolizing manager-developers round the SA. My personal role possess anticipate me to bring expert tips on contractual and you will liberties, enabling my personal readers browse the causes out-of structure laws and you will protect their financial investments.

Whether you’re making plans for your first generate otherwise trying to improve your method to build financing, just remember that , for each decision you will be making can have significant implications to possess the prosperity of assembling your project. I encourage you to definitely reach out to have professional advice and you will utilise the fresh useful information available to ensure that your design journey is both winning and you may worthwhile.