As rising cost of living and rates rose in recent years, very performed your house security for many homeowners. Today, profile has reached checklist levels, for the mediocre resident possessing near to $330,000 value of security . Meaning residents can certainly obtain a six-contour share if you find yourself however maintaining a healthy portion of the collateral so you can possibly use at a later date. Continuer la lecture de « And you will home equity fund are becoming less costly now that the Government Set-aside has begun reducing rates of interest »

Loan providers makes consumers pay for it premium upfront and you can incorporate it to their the financing imagine

Exactly what are FHA Improve refinancing will set you back?

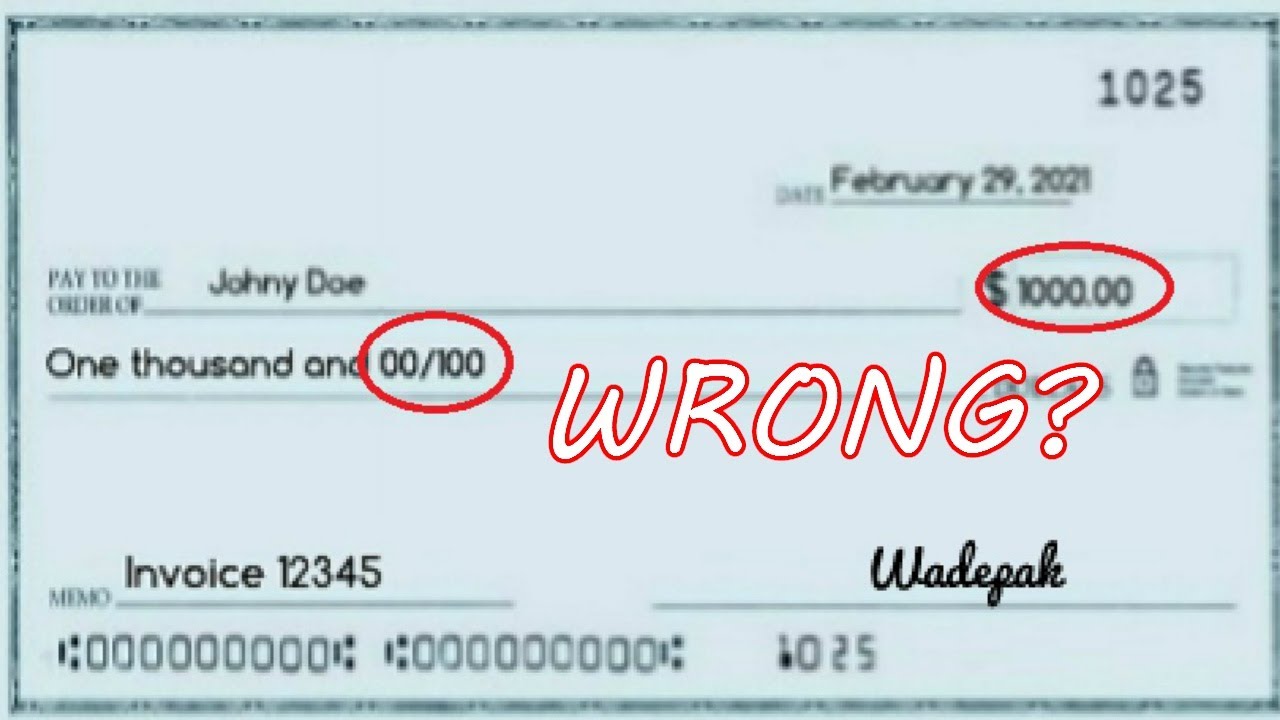

Most often, individuals are required to fund closing costs after they re-finance an FHA improve. The actual only real change having streamline refinancing closing costs would be the fact it does not require home owners to cover an assessment. Property owners can get to invest between $1000 and you may $5000 having FHA streamline refinancing closing costs. Continuer la lecture de « Loan providers makes consumers pay for it premium upfront and you can incorporate it to their the financing imagine »

Financial Mastery to have Owner Designers for the South Australia

- John Dela Cruz, Dominating Lawyer

Knowledge Manager Builder Funds during the South Australian continent

Navigating this new monetary channels available to proprietor-developers during the Southern Australia needs a-deep dive into truth off owner-builder finance. When you look at the SA, financial institutions render customized alternatives customized especially for those individuals trying out the fresh builder’s role by themselves. Yet not, talking about perhaps not your own work with-of-the-mill lenders; they are available due to their unique gang of standards and you can criteria owed toward seen improved chance.

Manager creator funds try distinctive line of because they necessitate a top equity needs and a detailed endeavor plan. Lenders want to see your capability to manage your panels efficiently, that has having good, council-accepted preparations and you may an obvious report on the anticipated framework can cost you. Engaging early having creditors you to specialize when you look at the holder creator finance Southern Australia can give you a sharper path towards protecting their funding. These fund often function adjustable words based on the project’s scope along with your financial history, reflecting the significance of a properly-wishing loan application.

Navigating Owner Creator Loans when you look at the SA

Protecting that loan because an owner-builder inside Southern Australia is somewhat challenging. The brand new difficulty is based on the need for comprehensive paperwork and you may evidence of power to manage a substantial structure endeavor. Loan providers have become careful, requiring sets from council-approved intends to an intensive cost dysfunction. Continuer la lecture de « Financial Mastery to have Owner Designers for the South Australia »

A new york village noted for their majestic mute swans face an emotional possibilities once you’re slain

- Display It:

- show into X

- show on posts

- express with the linkedin

- express into the email

The newest young people decapitated Faye, put their own so you can a close relative for cooking and ate their, police told you

MANLIUS, N.Y. (AP) – Female light swans has a keen outsize exposure contained in this upstate The new York town calculating lower than 2 rectangular miles. Its likeness is on town flags, neighborhood centers and you may welcome cues. Swan Fest is actually recognized for each slip. Continuer la lecture de « A new york village noted for their majestic mute swans face an emotional possibilities once you’re slain »

Carry out borrowing from the bank unions and banks look about the same for you?

In ways, they are. After all, extremely borrowing from the bank unions and finance companies render comparable services and products. The application process are about the same and you will the means to access this new establishments on the internet and on bodily towns and cities is additionally equivalent.

Here’s what you have to know throughout the banks, borrowing from the bank unions, and the ways to make best option to suit your currency:

Significant Distinctions: Banks compared to Borrowing Unions

The big differences would be the fact financial institutions are usually investor-possessed and-finances. Borrowing unions is actually regulated and you may belonging to its players. Another type of biggest improvement is that borrowing from the bank unions return earnings to help you players when it comes to lower rates of interest, quicker costs, and. Banking companies spend its earnings out over shareholders.

How Credit Unions Performs

Borrowing unions aren’t-for-cash monetary organizations that will be wholly belonging to their players. It take in places, promote economic properties, and you may setting exactly like a bank. But they’re not federally taxed eg banking companies, and perhaps they are totally managed and you will funded from the borrowing from the bank partnership people.

Borrowing unions usually have the requirements before you can feel a good associate. To be a part, you might have to:

- Reside in a certain geographical city (area, county, county, an such like.)

- Work with a particular career (such as degree)

- Benefit a particular employer (hospital, etc.)

- End up in certain groups (college or university communities, church organizations, an such like.)

- Have a close relative who has got already a cards union affiliate

You need to keep the absolute minimum amount of membership shares of the borrowing from the bank partnership through to joining, generally to have a moderate deposit of somewhere within $5 and you can $30. Continuer la lecture de « Carry out borrowing from the bank unions and banks look about the same for you? »

Advantages and disadvantages from Navy Government Borrowing from the bank Partnership

Navy Federal Credit Commitment business funds opinion

Navy Government Credit Relationship focuses on providing armed forces service professionals, pros, Agency from Safety professionals as well as their friends access high quality financial properties.

You need to be a card connection user towards its individual banking top before you could get company membership, and you will probably should be a corporate user before you could submit an application for a small business financing. Continuer la lecture de « Advantages and disadvantages from Navy Government Borrowing from the bank Partnership »

What’s the difference in old-fashioned fixed-price and you can changeable speed mortgage loans?

To own potential real estate buyers, thinking about what type of real estate loan is right for your economic demands and you may requirements are an important step in the home purchasing procedure. One of the most common loan sizes certainly home loan individuals try traditional loans. And then make an informed to buy decision, it is beneficial to know very well what a traditional real estate loan was in addition to various other benefits individuals traditional finance models could offer. Continuer la lecture de « What’s the difference in old-fashioned fixed-price and you can changeable speed mortgage loans? »