Tips get ready for the loan software

Pull to each other everything for a loan app can seem to be daunting, and could getting a small invasive. If you’ve never taken out a loan ahead of, meeting all your valuable most private finance guidance such as your credit card declaration and that suggests exactly how many takeaway coffee you had it day handy out over a bank can seem challenging.

Although not, like a visit to your doctor to have a physical, financing assessor has viewed all of it and you can odds are a good that you’ll be better within this typical purchasing details.

step 1. Exactly how much would you earn: This is exactly a glaring you to and easy on precisely how to confirm. Assemble electronic duplicates otherwise printing tough copies of your shell out slides. The brand new spend sneak should be no avove the age of three months and includes a-year-to-big date profile paid off. When you have an irregular money, a page from your boss making clear their renumeration agreements would-be an effective inclusion to incorporate. Even more income channels, like local rental income, funding otherwise bonus earnings otherwise international income may also must end up being demonstrated that have about around three months’ away from documentation. This is actually the exact same having overtime and you may allowances, if the these mode element of your income, a minimum of 90 days background might expected for.

And if you are lucky enough to suit your company to invest you a bonus (or bonuses), then you will need a 2 season history of these types of getting a loan provider to verify this money.

If you find yourself mind-functioning, then you will must have your financial statements and private tax yields from the ready for the last couple of years to-be able to confirm/make sure your revenue using this origin.

dos. Simply how much would you invest? The lending company can get request three to six weeks out of bank comments for the transactional accounts so they can identify incomings and outgoings. You can need provide duplicates from utilities costs, and every other home will set you back, including mobile expense, websites bills, energy, h2o and you will cost expense. Bank card statements for the past 90 days in an effort to ensure the actual life costs, very in the days leading up to birth this course of action you keeps an opportunity to score those profit in order. Is it possible you pay school fees? Regular vet bills? Most of these will need to be taken into account with obvious paperwork. Remember any insurance fees you only pay, along with individual health insurance.

Loan providers use various other metrics so you’re able to validate the costs, they trick is the fact talking about practical therefore a loan provider can also be see what your income was firstly, their life can cost you subsequently then be able to pertain brand new harmony of your own disposable income to your loans repair.

Half dozen Inquiries a loan provider Commonly Want to know and What you should Prepare for

3. Just what put do you have? The bigger the better. Essentially, there’ll be regarding 20 per cent of the property get speed saved up. This is a good suggestion for a number of reasons. To begin with, it will require a while to keep this much, very you’ll have an extensive and you can good offers background to display into financial. Secondly, it can signify your prevent Lenders’ Financial Insurance policies, a cost preserving of several several thousand dollars. In fact, it is strange for earliest home buyers for 20 for every penny deposit saved. The minimum put was four per cent, but when you have only a small deposit the lending company tend to need an incredibly close look after all additional situations, for example work stability and protection, using models and you may repaired costs plus credit history (discover our current blog post right here on things to do in order to improve your credit history ).

It might be best if you features from the 10 per cent protected. This will give you the most readily useful probability of a softer acceptance processes. Simply an instant mention on the becoming talented your own deposit because of the good parent or any other personal relative brand new deposit functions as a presentation away from deals triumph. Without having a solid reputation of savings and tend to be to provide in initial deposit that was talented for your requirements, the lending company need even more proof of having the ability to fulfill typical financial commitments. An effective about three-to-six-month checklist out of leasing money could possibly get serve however, be aware that particular lenders cannot think loan applications where the deposit try skilled into candidate.

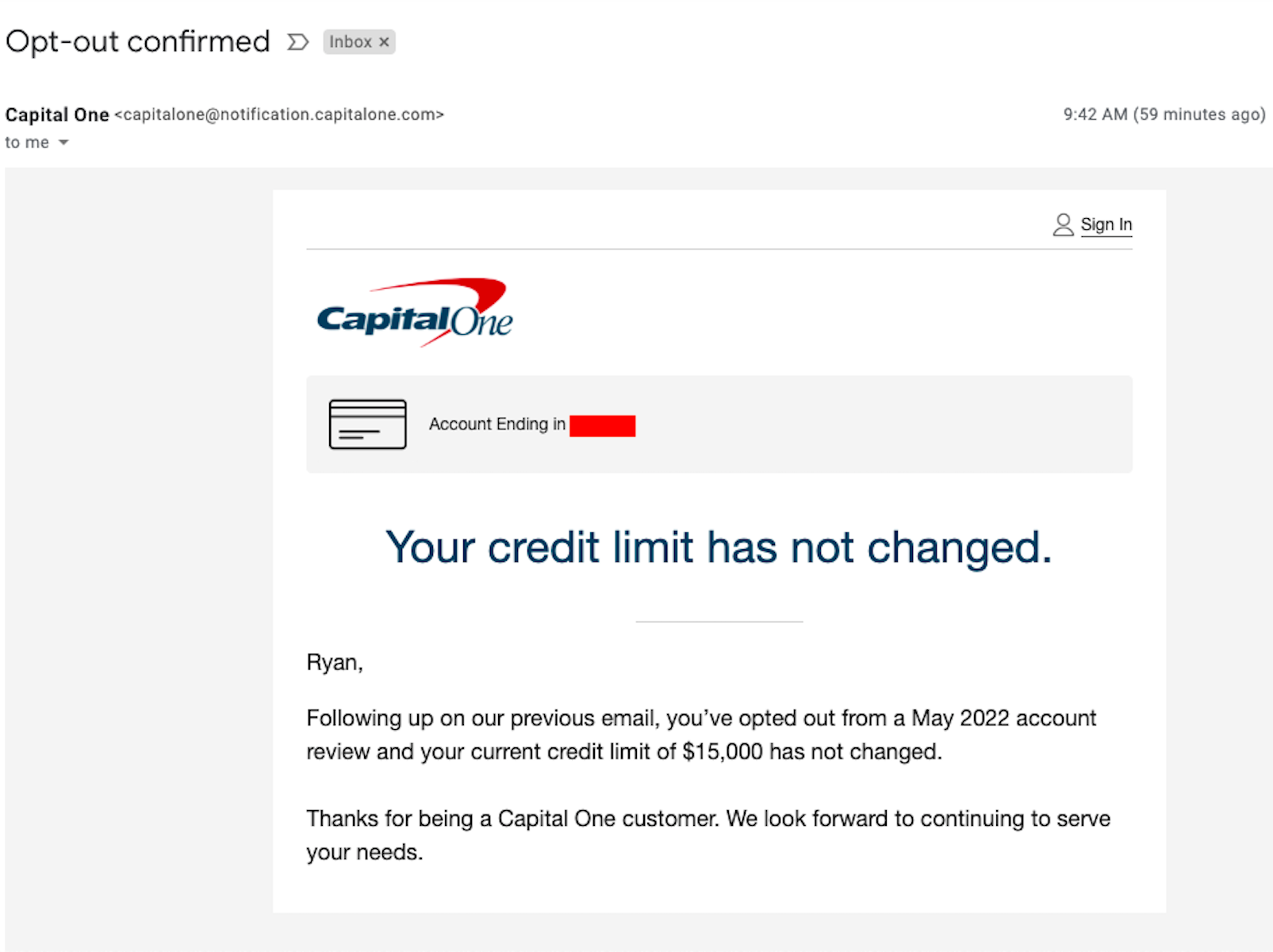

4. Do you have other financing otherwise obligations? Signature loans or any other economic duties should be revealed. When you’re for the a payment policy for early in the day costs, this should be announced that have documentation of your own fees record. You must be open and up-side together with your bank regarding the your financial obligations when making an application for financing. People mortgage membership which might be held, a lender should know very well what this new a good harmony is actually plus the month-to-month repayments.

Credit cards oh handmade cards… mastercard constraints has a life threatening effect on your overall credit capability. Unfortuitously evidently all of the a lot of people has possibly zero idea exactly how many notes they have or else what its full restrictions try.

From the maybe not revealing that it accurately to a loan provider this may be reveals a lack of borrowing from the bank acumen and you are clearly including trailing the brand new 8 ball straight from the brand new beginning.

5. What mortgage enjoys would you like incorporated? It’s your chance to imagine things such as a counterbalance membership, a beneficial redraw facility, if or not you need notice-simply for a period, or the power to make a lot more repayments as opposed to incurring fees. There are many different ways to customise the loan device to make sure this is the best product to you. A large financial company should be able to give you designed pointers that suits your specific points.

6. Can you greet a change to your needs in future? Whenever you are expecting a child, otherwise gonna changes services, thinking about moving, or expecting a family member to move within the along with you to possess a beneficial when you are anything that can impact your financial reputation have to be stated in order to the bank. Failure to achieve this possess a significant affect their price.

Interviewing the lending company need not be a daunting skills. Be ready, have your files ready and get obvious as to what you might want to explore. Regarding additional comfort and ease, thought consulting a mortgage broker make it possible for its expertise and expertise that will help you as a result of these issues. They will be in a position to chat your as a consequence of all the actions needed to score home financing and certainly will assist boost your possibility of victory.

Explore your specific needs & formulate the right technique for your. Be connected so you’re able to manage your own free 60min concept today!

All the details offered in this post is actually standard in the wild and you will payday loans credit cannot make up individual monetary recommendations. The information might have been prepared as opposed to taking into consideration a expectations, financial predicament or need. Before functioning on one information you have to know the latest appropriateness from all the details with regard to their expectations, financial predicament and needs.