Timing are that which you once you’ve felt like you to definitely playing with good HELOC in order to pick yet another house is the best option. If you’re planning to sell your home, you have to know all the advice and you may limitations for this kind of credit line. Before you use a beneficial HELOC to acquire new house property, imagine a few of the fundamental benefits.

Down interest levels: Loan providers generally speaking lay a high mortgage rates on the an investment property. When you yourself have loads of guarantee and borrow secured on the number 1 household, you will likely safe much lower prices.

Smoother certification: Having fun with a great HELOC to shop for a special house is always an excellent exposure. Although not, you can qualify more quickly occasionally. Youre offering your residence upwards because the collateral, and several lenders notice given that a beneficial marker off monetary cover.

Investment maintenance: Property owners, especially those approaching old age, may suffer confident with playing with a beneficial HELOC to get an alternate domestic. You may make much time-name points for folks who mark of a pension funds. You will additionally would not like borrowing from the bank out-of an urgent situation fund. You have access to dollars using your home’s guarantee but still continue on your own protected for the future.

No matter if you will be concerned with providing an effective HELOC to purchase a good new home, you’ve got additional options. Explaining the pros and cons apply to you actually can assist your most useful prepare for one second tips.

Bringing a beneficial HELOC might make experience while you are seriously interested in moving somewhere else or prepared to downsize so you can a very under control house. If you’re planning towards the playing with HELOC to acquire a special house, you need to package properly. Loan providers does not allow you to borrow on your property once you’ve listed it. You’ll want to safer your own line of credit before you could call a representative.

Loan providers generally you should never worry the manner in which you pay off your own HELOC. You can start organizing the intends to sell so long as your repay it entirely before you could romantic on your basic property. You might not be able to use your domestic once the collateral for the newest HELOC after you no more contain it.

An easy way to replace your finances prior to getting a beneficial HELOC

You may need to change your economic wellness before you can imagine having fun with a good HELOC to acquire another type of domestic. Preserving, making assets, and you may lowering into the purchasing is a lot of time-identity ventures. Give your bank account an enhance before you could score a HELOC to purchase brand new home on adopting the suggests:

Tune the paying: Take a look at in which you invest the majority of your money. Opinion and you may select the non-basic principles, instance eating out and you will activities. Calculating the expenditures at the end of per month can be excel a white into the where to tighten your financial allowance.

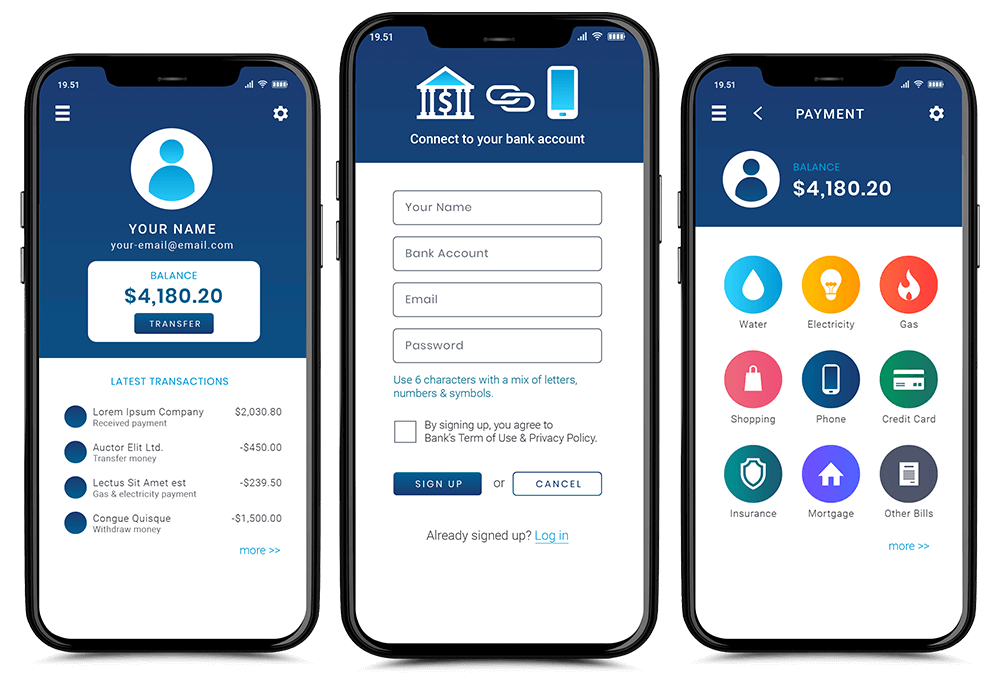

Include your self on the web: Speak about mode alerts on your own bank accounts and you may credit cards. The companies are able to let you know if you have people unusual otherwise suspicious passion. Just be sure to safer your bank account in advance of playing with HELOC to help you purchase a different sort of domestic. Ensuring that debt account passwords try novel is a good first rung on the ladder.

Replace your individual savings rates: You might assess your own disposable income in a few tips. You will need to determine one another your revenue and you may coupons on the seasons. Following, you will split your deals by the income and you may multiply by 100. Boosting your percentage part offers better protection when you use a good HELOC to purchase brand new home features.

Increase your credit score: Pull your credit score observe what you’re coping with. You can access best costs that have a higher credit history and possibly cut 10s to help you tens and thousands of dollars on the long lasting. Come across credit report attributes that give soft brings so you dont occur to affect their score.

Using an effective HELOC to acquire a new home is not a simple or simple choice. If you are searching some other ways to prepare for new sizable financing, be connected. All of our home loan experts will look at your profit and supply belief having you’ll be able to methods moving forward.

Advantages and cons of using good HELOC to have an all the way down fee

Delivering cash out of first house to cover an all the way down fee for a separate residence is high-risk. The advantages and you can drawbacks of utilizing a beneficial HELOC to order a brand new home disagree for all.

No equilibrium: You may spend days navigating the new homebuying techniques. If you undertake a vintage dollars-out loan in lieu of using a good HELOC to get another type of home, you might exposure settling the loan before you can have fun with all of them. You can keep an effective HELOC on a zero harmony and give a wide berth to expenses it off up until you will be willing to make payday loan? use of the bucks.

Rotating line of credit: You can repay and recycle your own HELOC personal line of credit. Make certain you never meet or exceed their put credit limit.

Shedding your home: Adding the first family because the collateral often harm your if you’re not prepared. Their bank get foreclose on the first assets if your 2nd home drops courtesy and also you standard on the HELOC.

Highest rates: You may need to pay highest rates when using a beneficial HELOC buying new home features. Weighing the options before having fun with HELOC to buy a special domestic and you may determine whether you could potentially would new changeable interest levels.

You may want to defense a separate home’s downpayment rather than providing your most other household. Some of the methods range from talking-to a person that you was next to to own let or getting other businesses. Some of these direction choices are:

Even if you’re sure trying to sell sooner rather than later, go through the much time-title consequences. The only thing that’s riskier than taking a great HELOC or similar loan is only thinking in the short term.

Come across a loan provider you can trust

Make your lifetime much easier by comparing the you are able to down payment solutions with the help of our down payment calculator. If you get one of the loans, our financial consultants will help take you step-by-step through the fresh prequalifying methods. In the Western Financing, we understand one to playing with HELOC to shop for a unique house works well with people. We still try and look at per financial situation and offer advice for standard, custom solutions.