Sure, you can purchase to your a house once more just after a bankruptcy inside the Delaware and any other state, but be equipped for highest interest rates. A bankruptcy proceeding will continue to be on https://elitecashadvance.com/loans/student-loans/ your credit history for eight in order to ten years, it ends up affecting your borrowing from the bank notably immediately after 2 yrs if your report might have been upgraded precisely. If you wish to apply for a mortgage immediately following an excellent personal bankruptcy submitting telephone call 302-703-0727 or Pertain On the web

Make sure you look at your credit report a-year, and make sure that account that have been section of your own personal bankruptcy have been discharged. Solicitors receives a commission in order to document the latest personal bankruptcy and have no attract in making sure your credit score is actually real adopting the personal bankruptcy.

What kinds of Personal Bankruptcies are there?

There are two main sorts of bankruptcy for personal bankruptcy: A bankruptcy proceeding and you will Section thirteen. A section seven Bankruptcy proceeding is the even worse of these two when you look at the this new vision of any creditor given that an excellent Ch.eight wipes aside all of your current costs and your former financial institutions score absolutely nothing. Which means you reach begin more which have a clean record. A part 13 bankruptcy is not seen almost given that bad as the a part 7 given that rather than cleaning your debts your get into a repayment bundle with creditors.

The rules so you can get home financing immediately after a bankruptcy are very quite similar regardless of which kind of mortgage system you is applying for. The guidelines differ getting a chapter eight in the place of a section 13. Here are the recommendations for each:

The way to get good FHA Home loan Shortly after a part 13 Bankruptcy

Chapter 13 Bankruptcy proceeding: Whenever you are currently still on Chapter 13 and are actively investing involved, you’ll want experienced they for at least one year and possess started newest to your all your money. you will you want consent regarding the trustee of bankruptcy. You should also have lso are-based the borrowing from the bank (minimum 620 FICO rating) and have zero derogatory information as you recorded Section thirteen.

If you have been discharged throughout the Chapter thirteen next truth be told there isn’t any wishing several months getting applying for a home loan you will have to has re also-centered their borrowing from the bank (minimum 580 credit history) and you also need to have didn’t come with derogatory information on their borrowing from the bank as Chapter thirteen discharge or even in the final 24 months in the event that discharge is more than 2 yrs ago.

Getting good FHA Mortgage Once a part eight Personal bankruptcy

Chapter 7 Personal bankruptcy: You really must be discharged from the Chapter 7 for around 24 months. You really need to have lso are-dependent your own borrowing from the bank (620 minimum credit score) and also no derogatory information regarding the credit history on the past 2 years. You must not simply have a good 580 credit score however you need to have active tradelines (mastercard, car finance, personal loan, etcetera.) in your declaration as the bankruptcy proceeding which can be for the a good standing. You ought to also have a very good explanation for why you recorded this new bankruptcy proceeding and exactly why it does never happens once again.

Getting a home loan 1 day Just after Personal bankruptcy that have PRMI Fresh Initiate Program

You can get a home loan 1 day away from Part 13 Case of bankruptcy, Chapter 7 Bankruptcy proceeding, Foreclosure, Brief Product sales, or Action instead on PRMI New Begin Mortgage Program

- Minimum Credit score are 580

- Must have Minimum 2 Tradelines

- Loan Number away from $75,000 to $1 million

- Restriction DTI of fifty% (Around 55% having Compensating Affairs)

How do you Re also-Establish Borrowing After a bankruptcy?

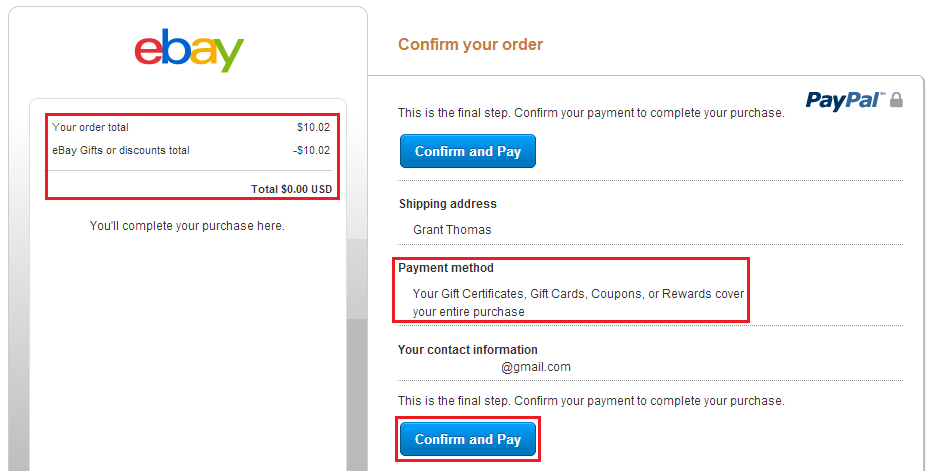

Most people have trouble lso are-establishing credit following case of bankruptcy, a sensible way to re also-expose the credit is to obtain a protected bank card. There are a few cards that charges higher charges each month to own brand new credit. The correct one that we have found which can accept nearly individuals to the credit try a guaranteed Visa Card, simply click less than to make use of.

If you prefer to apply for a beneficial Delaware Financial once a case of bankruptcy filing or launch, you could Implement On the web Right here , you could potentially name John Thomas during the 302-703-0727.