Jessica Brita-Segyde

Are you presently purchasing a property? If so, well-done! This really is a captivating for you personally to, all your family members, and your future. Upfront looking, it is critical to get pre-acknowledged to own a home loan. The brand new pre-recognition techniques is straightforward and certainly will place you off to the right path so you can homeownership.

As to why Rating Pre-Recognized?

Specific people ponder in the event that pre-acceptance deserves their go out. Anyone else get question whether or not an excellent pre-recognition page needs in the event the market is modifying or whenever cost are low. You need to get pre-accepted regardless of business styles, and you will here’s as to the reasons.

Inside an excellent Seller’s Field: Nowadays, pre-recognition is important. Why? Whenever offers abound and you will home was scarce (we.elizabeth. a beneficial seller’s sector) you ought to let you know owner that you have the credit in order to straight back-enhance bring.

When Costs Was Swinging: It’s important to get pre-recognized if the rates are likely to trend up in the direction of your property browse. Getting the earliest steps to investment in place helps it be you are able to to help you lock your price when you and your home party are set.

In any Markets: In almost any markets, pre-recognition works well because lets you along with your broker understand what you are able manage as well as how far your fee would be.

Yes, pre-acceptance have a tendency to however benefit you regardless if that isn’t the first home get. You’ll learn simply how much house you can be eligible for and you can what your fee would be. Along with, you will have a lot more settling strength since the a purchaser should your proper home moves industry. Another type of question sellers need to answer is whether or not they renders a deal on the a different domestic before attempting to sell its existing you to. Pre-recognition allows you to determine an informed time about your closing big date to suit your buy exchange and also for your product sales.

Should i Get Pre-Approved to own a residential property?

If you find yourself getting into the latest resource online game, pre-acceptance can help you see whether its feasible so you can lease your own present family unlike attempting to sell.

Exactly how soon ought i initiate the process?

Exactly how soon if you get new monetary equipment turning? Pre-approvals history sixty to help you high risk loans near me 3 months. If the pre-approval expires, your own bank will require upgraded documents and you will an additional credit pull. That isn’t a big situation economically, it can cost you time and maybe a few activities on your own FICO get.

The first grounds regarding timing will be to get pre-recognized ahead of time seeking a home and you can certainly in advance of you make a deal.

Just how many Pre-Recognition Emails Do i need to Rating?

If your pre-recognition letter comes from a powerful, acknowledged bank, you merely need one to. You can look around observe exactly what some other lenders can offer with regards to money, but keep in mind that pre-approvals will result in a card eliminate. It cannot negatively apply at your credit score because of the far, but lenders and other creditors will get ask you to explain the multiple inquiries on your own report. With regards to the Experian blog, an arduous query as a result of a home loan preapproval credit assessment you are going to lower your score because of the a few items but so it get cures is normally small-existed.

What does the lending company You would like regarding Myself?

Mortgage loans try underwritten using the Consistent Residential Loan application (URLA). You will end up asked all axioms: Name, address, at the job, the month-to-month income, what kind of cash you really have in the financial, and just how much currency you borrowed from to help you someone else. New URLA also asks regarding properties you own, the address history (if you have resided at the most recent area less than 2 years), while the funds you will employ getting an advance payment. Additionally, you will answer certain questions about class and military provider.

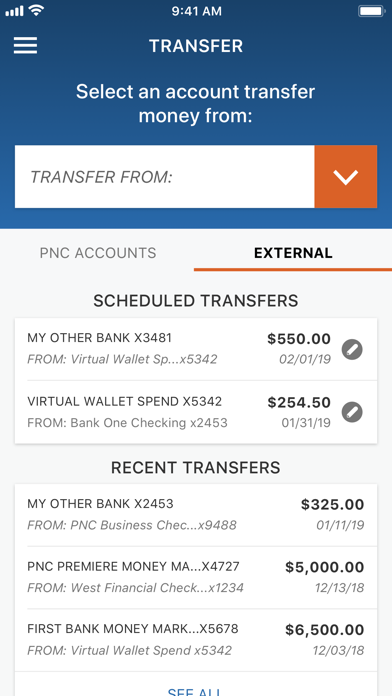

To have a great pre-approval, most of that which you disclose toward URLA could well be assumed true. Records, including bank comments and taxation variations, are expected before last approval is awarded. Attempt to provide their personal safeguards count so that the lender normally pull your credit report. Most of the time, a credit rating is needed prior to a beneficial pre-acceptance page is going to be awarded.

The direction to go

Play with the calculators, guides, or any other tips to increase their homebuying discover-exactly how. Begin strong to acquire you to dream home while having preapproved online in only ten full minutes. Get in touch with a Ruoff Financial Advisor during the one of our 70 locations nationwide. We’re going to show you from the process of purchasing your dream family.