Important: PropStream will not offer financial pointers. This information is for informational motives simply. Since your family can be used once the security with of this type of financing selection, i encourage talking-to an economic mentor and you will/or law firm to make sure you will be making probably the most educated decision in advance of moving on having some of these money options.

Since the a genuine home buyer, you’re interested in innovative a way to fund your next money spent otherwise renovate an existing you to definitely rather than saving up a great highest down-payment.

Did you know for many who already own a house, you’re able to utilize their collateral for these motives?

In general, you can find around three well-known brand of finance one change your property security to the cash to own a residential property: a home security financing, an effective HELOC, and you can a face-to-face home loan.

What https://paydayloansconnecticut.com/bigelow-corners/ exactly is a home Guarantee Financing?

As name ways, a house security mortgage allows you to tap into their security to help you money commands. (Collateral is when much you reside value without having the loans you borrowed with it).

Family collateral loans are entitled next mortgages as they setting similarly to an interest rate. Normally, you receive the bucks just like the a lump sum and you will pay it back having appeal each month getting an appartment identity-generally off five so you can 2 decades or lengthened.

Like other mortgage loans, household equity funds usually become attract, items, charges, and other charge. Their interest costs are usually fixed, for example they stand an equivalent for your longevity of the loan. Some buyers choose such mortgage by the foreseeable monthly obligations.

The amount you can obtain depends on their bank and your financial situation. However in standard, your loan matter is typically simply for 85% of your security you may have in your home. Then you can use this money to fund personal expenses, domestic renovations, or the purchase of your next money spent.

Remember that your property acts as security using this type of style of loan. So, if you cannot repay the loan, your own bank might be able to foreclose at your residence.

Family Security Loan Requirements

To find a property equity mortgage, your normally you want at least 20% security in your assets and you can a loans-to-money proportion (your own overall monthly financial obligation payments split by your overall monthly income) away from 43% or faster.

Loan providers together with look at your borrowing fitness. You will likely you want a credit rating of at least 680, with respect to the borrowing from the bank agency Experian . Other choices are for sale to people who have straight down credit scores, however these fund fundamentally have highest interest levels.

- Obtain the mortgage because the a lump sum payment.

- You could fundamentally merely use as much as 85% of your property security.

- Rates of interest and payment wide variety is actually fixed.

- You must meet specific borrowing and you will money requirements so you can qualify.

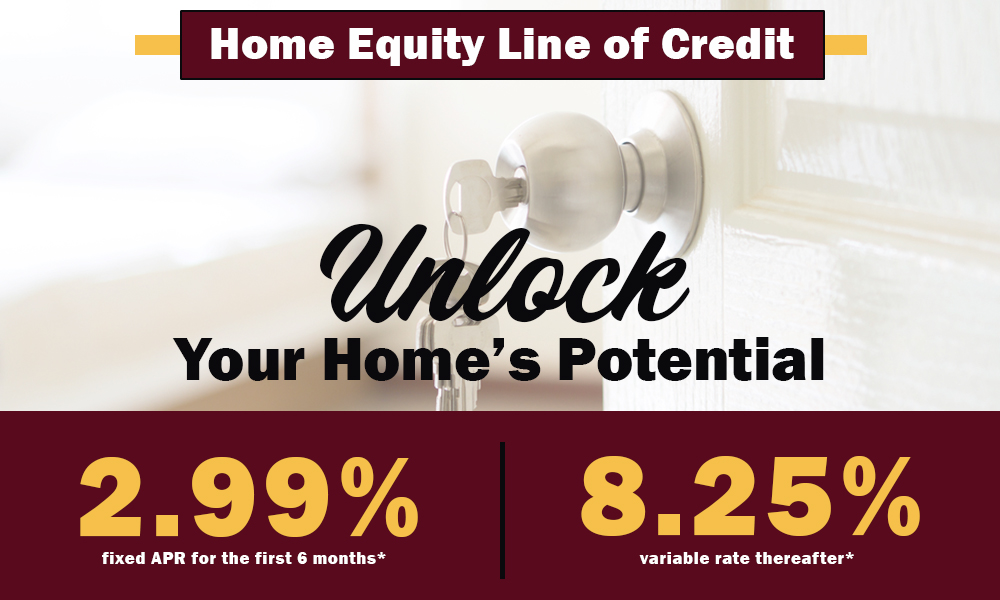

What is actually a great HELOC?

Like a home guarantee mortgage, property equity personal line of credit (HELOC) allows you to utilize your collateral to access water cash.

But as opposed to a house collateral financing, an effective HELOC work more like a charge card. Unlike choosing the income due to the fact a lump sum, you obtain on account since you need up to a beneficial preapproved total count. This number is based on your guarantee, credit wellness, and financial. Then you pay off anything you obtain that have interest.

You can pull funds from it membership multiple times, but many HELOCs require you to get it done within this a window of energy entitled an excellent draw period, and that typically persists from the four in order to a decade. Pursuing the draw several months is over, you might be in a position to renew the latest line of credit in order to keep using it.