Regardless if you are seeking collect your dream home from the a stone-bottom rate or turn a quick finances having an effective fixer-top, public auction assets purchases should be precisely the procedure. Purchasing property at the market try smaller and simpler than simply to-be region of a conventional property strings, as well as the deals offered try irresistible.

However, once the characteristics purchased at public auction call for timely payment, typically within 28 weeks, conventional mortgage loans don’t have a lot of important value. To the normal residential mortgage currently taking about three weeks in order to program, that it 28-day percentage due date need an alternative money service.

The advantages of property auctions

One immediate benefit of to purchase properties from the public auction is the speed and ease of the order. In this twenty-eight months, the house get and you will import procedure within the entirety is finished. You benefit from the all the way down costs afforded so you’re able to bucks people, and there’s zero likelihood of becoming gazumped’ from the fighting bidders.

On the other hand, a significantly bigger set of residential property wade underneath the hammer from the market than simply show up on the typical assets sector. Land that have to be offered immediately, functions trying to find fixes and you can home improvements, and you can low-important qualities sensed unmortgageable’ of the big banking institutions-all potential great deals throughout the and make.

You’ll be able to get local rental services on market that currently have tenants located in all of them, letting you initiate event regular lease costs in less than thirty day period.

The disadvantages regarding property deals

For the drawback, the reduced exchange times for the auction property instructions can prove challenging. In case your quote is successful, you’re expected to spend a low-refundable reservation payment on the spot.

It dos.5% of the property’s assented rates (along with VAT) or a-flat percentage of approximately ?5,000. Brand new agreements do not need to become finalized and you may replaced best out, but you’ll forfeit that it initial reservation commission for payday loan Carlisle Rockledge those who straight back outside of the offer.

Through to signing the deal and agreeing purchasing the house or property, you might be anticipated to pay a good 10% put. To date, you’ll will often have 28 days (both some expanded) to build other currency.

Yet another disadvantage so you can assets deals ‘s the chance of being outbid, that could takes place after paying to possess a proper survey of the assets. There are even no claims one to your personal may be the winning quote, no matter exactly how many lots you quote to the and exactly how of many auctions your sit in.

Capital a public auction pick

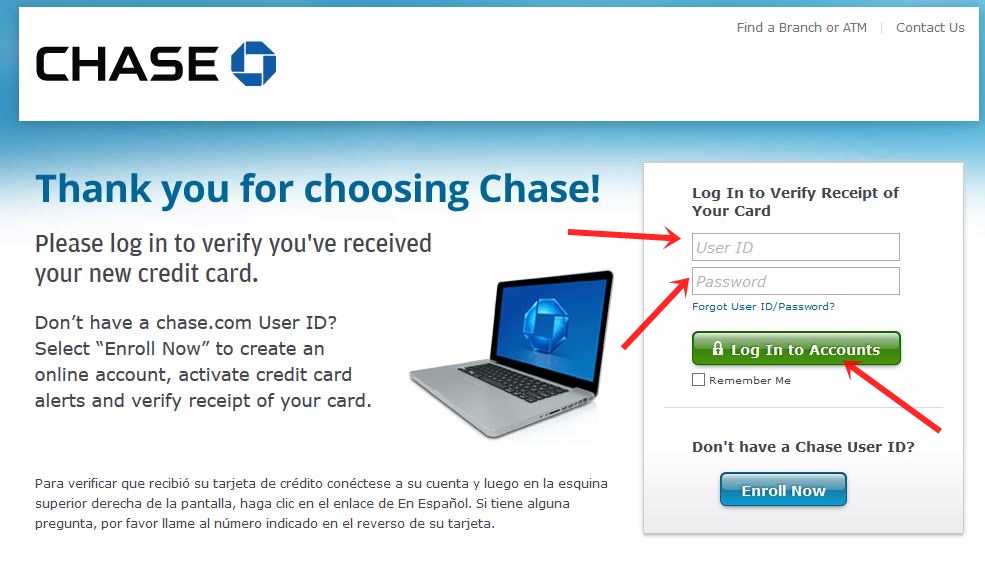

The amount of time-important character regarding market possessions orders need anything much swifter than simply a traditional home loan. Concurrently, it is vital to plan the necessary financing before auction, in the form of pre-recognition otherwise a choice theoretically. This may allow you to availability money you want if their bid works without having to initiate your application out-of abrasion.

Very people pay the ten% deposit toward homes they get from the market out of their individual pockets, or perhaps due to a personal bank loan otherwise a credit card payment on the day. So it is crucial that you ensure you gain access to so it 10% put at the time by itself, otherwise their bid might be cancelled therefore the assets marketed in order to anybody else.

Connecting funds having public auction property costs

Perhaps one of the most much easier and value-effective ways to fund an auction property get try connecting money. In which recognition is actually gotten beforehand, a connecting loan are going to be set-up and accessed contained in this a few working days.

Bridging finance will likely be safeguarded up against extremely sort of property otherwise property and certainly will be used to find any kind of property, no matter what the condition. This will make it a particularly suitable facility to possess market possessions commands, in which non-basic land in questionable claims of fix tend to wade underneath the hammer.