Pro Rates

« PMI performs an important role during the expanding homeownership potential to possess basic-big date people. Even though it adds initial costs, PMI opens up the doorway to help you homeownership for the majority of borrowers who don’t has actually high advance payment coupons. » – Susan Becher, Elderly Vice-president, American Bankers Home loan Relationship

« Borrowers need certainly to cautiously evaluate the will set you back off PMI up against its goals and you can finances. In certain situations, this may build alot more sense to go to and you can save a much bigger down payment to end PMI completely. » – Mark Cantril, Authoritative Economic Planner, President of FinVisor LLC

As well as certified professional estimates and you can feedback like these can be lend even more dependability and you can weight into findings consumed in brand new article’s last point.

By the adding improvements such as level PMI’s records, industry statistics, affordability impression, graphic instances, and you will specialist viewpoints, this article becomes a really full and elite resource on the thing of individual financial insurance policies.

End

Individual home loan insurance coverage caters to a significant objective inside making it possible for individuals in order to purchase home in the place of getting 20% off, while also protecting lenders up against excess standard chance. For the majority of, investing a PMI superior is actually a fair tradeoff to become an excellent homeowner eventually rather than prepared decades to keep a much bigger off commission.

Yet not, the costs out of PMI can be put an extra economic strain on individuals, particularly in high-costs property segments. Exploring solution reasonable-down-payment loan choice otherwise rescuing even more to own good 20% down-payment to avoid PMI is smart considerations.

Individuals is always to cautiously assess the quick and you may a lot of time-title PMI will cost you in the place of its finances and you may needs. Immediately following received, they should display their mortgage’s equity gains so that you can terminate this new costly PMI advanced whenever guarantee lets, sometimes thanks to adore or if you are paying off prominent.

Talking to a lending company and powering the brand new wide variety toward additional PMI problems is ideal to help make the really informed choice for your particular property needs and you may earnings.

Private Mortgage Insurance rates (PMI) is insurance policies you to conventional mortgage brokers wanted regarding homebuyers exactly who obtain fund which have less than 20% down.

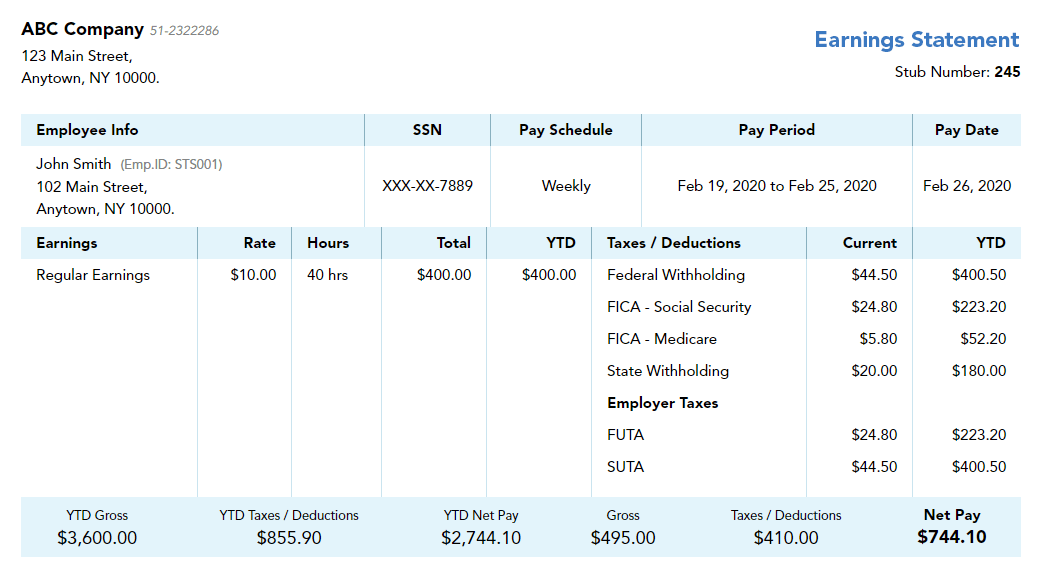

PMI cost can vary throughout 0.55% so you’re able to dos.25% of brand spanking new loan amount per year. Towards the an excellent $300,000 home loan with 5% down and 0.85% PMI rate, new month-to-month premium might be $.

You should shell out PMI premium up until your loan is located at 78% loan-to-well worth proportion based on the unique value of/cost. You can also request PMI termination once you come to 80% guarantee.

Yes, possibilities include putting 20% or more as a result of stop PMI, delivering another mortgage to pay for an element of the advance payment, obtaining authorities-recognized finance versus PMI standards, otherwise purchasing high rates with bank-paid PMI options.

Your the fresh new mortgages originated immediately following 2021, PMI premium are currently perhaps not tax-deductible. not, existing mortgage loans I deductions predicated on earnings limitations.

Zero, PMI simply protects the lending company in the event you prevent making your mortgage payments and they have so you’re able to foreclose towards the property. It provides zero head advantage to the fresh borrower.

A portion of the indicates is looking forward to they to automatically cancel on 78% LTV, asking for cancellation at 80% LTV with a brand new appraisal showing enough guarantee, otherwise from the refinancing once you have more than 20% collateral built up.

Sure, some lenders provide a loan provider-paid back PMI alternative where they spend the money for initial advanced, but you undertake increased total rate of interest to compensate all of them across the loan name.

The common down-payment round the every antique mortgages in 2022 was 15%. The most popular PMI rates having regular consumers varied away from 0.58% in order to 0.85% of your own totally new amount borrowed.

- Split Premium PMI – This option comes to both an upfront PMI percentage at closing since the really given that all proceed this link here now the way down ongoing yearly superior compared to BPMI.

But not, experts dispute the new monthly PMI premium adversely effect value having low and you will modest-earnings property. Certain consumer advocacy teams keeps requisite reforms otherwise elimination of PMI programs adjust houses value.