Article Advice

When you could possibly get your number 1 house with almost no currency off, possible generally need certainly to put down about 15% if you would like purchase a rental assets. Along with the median cost of a house hanging around $399,000, that comes out to nearly $sixty,000. This significant chunk regarding alter is a huge reasons why they should be difficult to break for the real estate expenses than just personal loans Colorado it is to find a house you can live-in.

However, that doesn’t mean you don’t need to choices – we shall safety tips for elevating a massive deposit and you will implies you can top-step you to definitely steep minimum requisite.

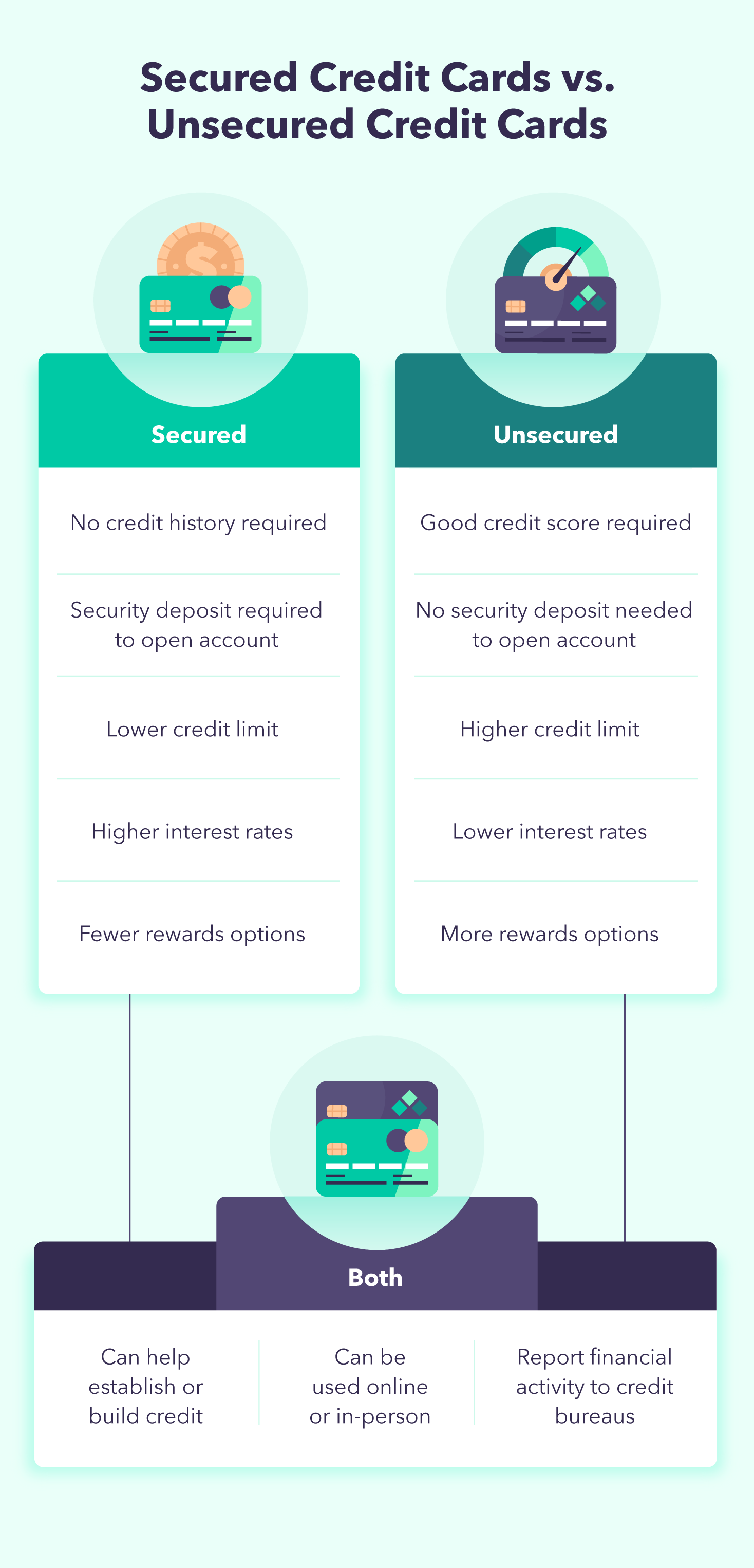

Usually, minimal downpayment number to possess a traditional investment property loan are 15%. Yet not, multiple situations will determine the real advance payment requirement, together with your credit score, debt-to-money (DTI) ratio, financing program and you may property types of.

When you need to avoid the higher down-payment that comes that have investment property funds, you might also fool around with an owning a home method called home hacking. Continuer la lecture de « Simply how much investment property can i manage? »