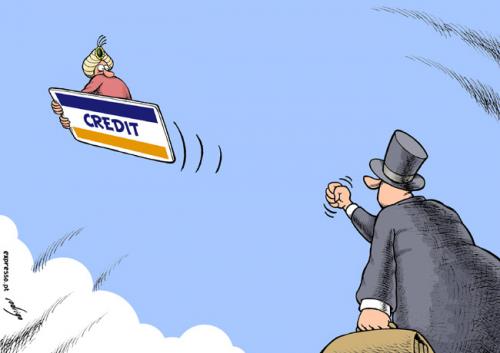

Streamline Re-finance

Being qualified government-covered mortgage loans line re-finance otherwise a beneficial Virtual assistant streamline re-finance. Using this choice, a unique appraisal is not needed. This helps keep the closing costs down, it is therefore an affordable integration selection for individuals who meet the requirements. Understand that FHA and you will Virtual assistant Improve refinance choice won’t enable you to consolidate financial obligation towards loan. As an alternative, they help you decrease your monthly obligations, providing you entry to a lot more of your month-to-month money to invest off existing bills. You also need to be in a preexisting FHA otherwise Virtual assistant mortgage.

Become approved so you can refinance.

Like most financial decision, you will need to research your facts and consider any choices. When deciding in the event the a funds-away financial refinance is best for your, question the second issues.

Will i Be eligible for A mortgage Re-finance?

- A credit rating more than 620 (580 for Va financing otherwise FHA financing in regards to our customers who is paying loans in the closure table)

- At least 20% collateral in your home (except for Va finance)

- Good 50% or all the way down obligations-to-income (DTI) ratio

- Adequate currency to cover settlement costs

- Proof of income

Carry out I’ve Enough Equity?

Since the you will end up by using the collateral of your home getting a cash-out refinance, you’ll want to have sufficient to help you borrow while keeping certain equity remaining in the home. This really is a requirement of most lenders. Continuer la lecture de « In the event that you Refinance Their Financial To Consolidate Financial obligation? »