In the present big date scenario, in the event the a house costs are instead highest, to purchase a property becomes an uphill activity for the majority of from united states. Thankfully, finance companies, casing boat finance companies, and you will low-financial financial institutions bring Mortgage brokers, whereby it give funds as much as 80% of your own market price of the home. We only have to arrange for the remaining 20% to help make the down payment.

Home financing do allow extremely much easier to make so it big-ticket buy; yet not, you must understand the resource to own home happens at the a keen additional cost, by the way the pace billed towards loan amount. The expense of interest was higher, particularly given that a mortgage last anywhere between 10 so you’re able to thirty years.

A great way to cut down on the eye outgo try while making prepayments into the Mortgage. Why don’t we understand how to plan prepayment out-of financial and you may slow down the entailing costs inside the increased detail in this post.

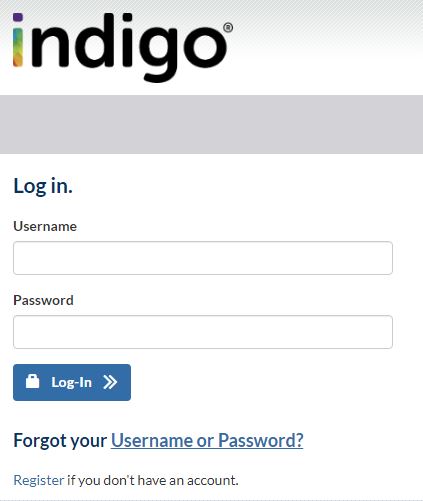

Anyone can Make an application for Lender away from Baroda Home loan and you can have a look at EMI, Rate of interest and you may Qualification On the web so you can avail give.

Home loan Prepayment

You might prepay the home financing partly or complete. If you want to make the improvement percentage in part, extent paid down have to be equivalent to or even more than several months’ out-of EMI. A great prepayment is oftentimes made as an easy way of decreasing the complete desire outgo, by effortlessly decreasing the period. And, it can also help reduces the weight of enough time-identity financial commitment one a mortgage constantly is.

Prepayment Punishment

Since prepayment reduces the Home loan period, it explanations loss of interest inflow on the bank. Continuer la lecture de « Prepayment from Home loan: Charges & RBI Statutes »