Mississippi’s S.An effective.F.Elizabeth. Mortgage Act (Safer Operate) is actually booked as repealed with the , Governor Bryant recognized Senate Costs 2504 (S.B. 2504), and that reenacts the fresh new Secure Operate and you can tends to make loads of substantive alter on the requirements beneath the Secure Work that can be interesting to home-based mortgage lenders, originators, brokers, and you will servicers working into the Mississippi. This type of changes are effective . A list of some of these transform exists lower than.

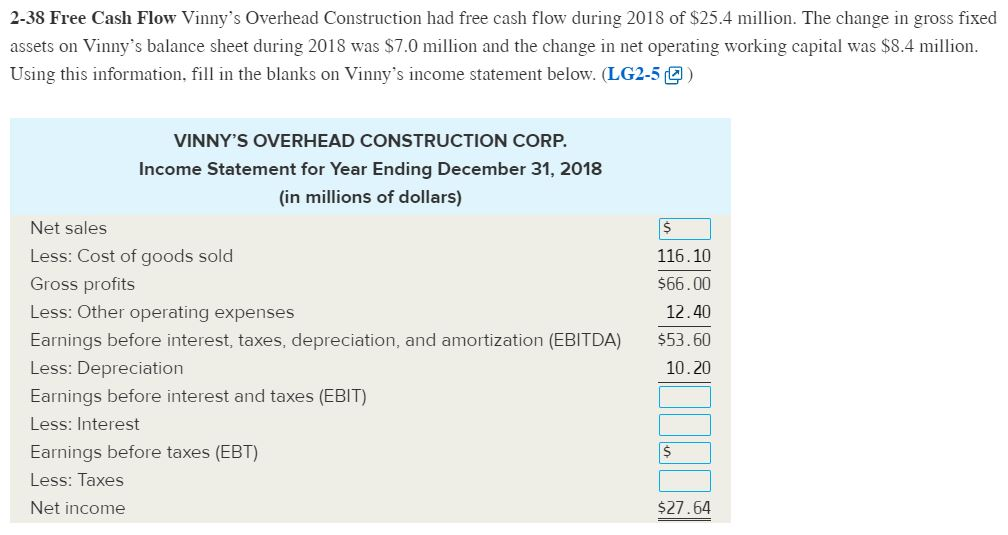

S.B. 2504 amends the fresh new carried on degree conditions within the Secure Operate of the (1) reducing the number of era away from training a licensed real estate loan inventor need over from year to year out of a dozen to 8 circumstances and (2) reducing the requirement one an authorized originator obtain couple of hours of Secure Act education every year.

Since , an authorized mortgage lender will no longer be asked to declaration any misdemeanor belief, in which fraud is an essential element, of any of the organization’s administrators, manager officials, qualifying private, otherwise loan originators

- around three period from government rules and you can laws and regulations studies;

- two hours from integrity studies, which need become classes into fraud, user protection, and you can reasonable lending circumstances; and you will

- two hours of coaching toward nontraditional home loan equipment areas lending conditions. Continuer la lecture de « Mississippi Amends and you may Reenacts S.A good.F.E. Financial Work »